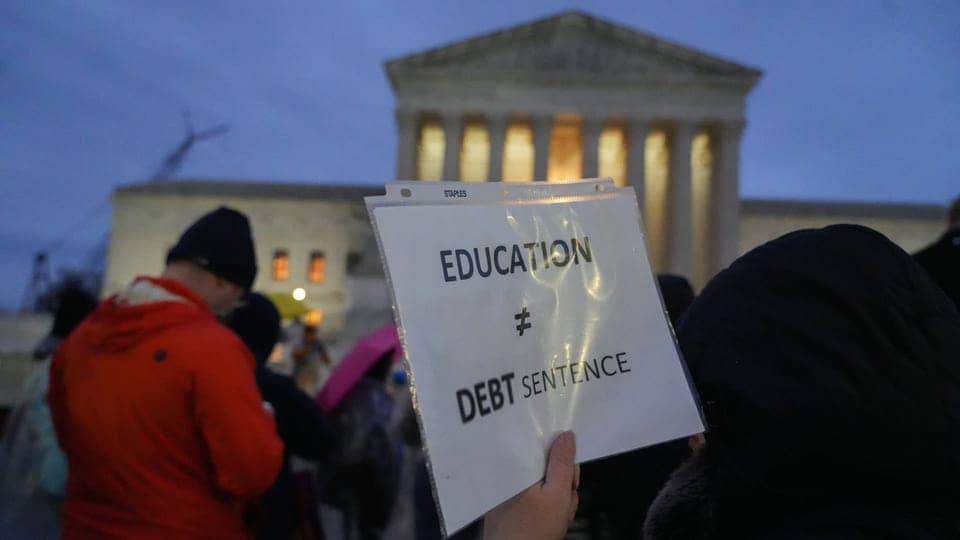

The recent Supreme Court rulings on student debt relief and affirmative action in college admissions have raised concerns among students and advocates, signaling potential barriers to higher education and reducing diversity.

The Supreme Court’s recent decisions on student debt relief and affirmative action in college admissions have left students and advocates concerned about the accessibility and inclusivity of higher education. These rulings, which reject mass student debt relief and the consideration of race in admissions, have reinforced existing obstacles and amplified the perception that higher education is becoming an exclusive realm.

The ruling against mass student debt relief, which was intended to alleviate the financial burden on millions of borrowers, has dashed the hopes of many individuals seeking relief from the staggering costs of education. Additionally, the decision to eliminate the consideration of race in college admissions undermines efforts to reduce barriers faced by Black and brown communities striving to break free from generational poverty.

Angelique Albert, the overseer of the Native Forward Scholars Fund, the largest provider of scholarships for Indigenous students in the country, expresses her concern, stating, “It feels like the barriers are going back up for us.” This sentiment resonates with many who fear that these rulings reinforce existing obstacles to higher education and create a sense of exclusion.

Despite these setbacks, the Biden administration remains determined to address student loan issues through the Higher Education Act (HEA).

While the administration aims to provide relief and offer a one-year reprieve on the consequences of missed payments, such as negative credit reporting, the process of implementing the HEA reforms is lengthy.

Furthermore, interest will continue to accrue during the reprieve period from October 2023 to September 2024.

Amidst the ongoing struggle to find a viable solution, it is essential to acknowledge the scale of the student debt crisis. During the short period in which the application process was open, approximately 26 million people applied for or provided information to demonstrate their eligibility for debt forgiveness. Out of these, over 16 million borrowers were approved for relief of up to $20,000, potentially benefiting up to 43 million people. For 20 million borrowers, the plan would have eradicated their entire outstanding debt.

A survey conducted by the Native Forward Scholars Fund revealed that nearly two-thirds of the debt accumulated by Native scholars was due to student loans. Furthermore, data from the Federal Reserve Bank of St. Louis indicates that young Black women bear the highest burden of student debt, with an average loan balance of $11,000. The intersectionality of race and gender exacerbates the disparities in student debt, with women generally more likely to hold debt but facing slower repayment due to lower incomes.

The consequences of mounting student debt go beyond personal financial struggles. Black college and university enrollment has seen a decline, with a 22% drop between 2010 and 2020, affecting over 650,000 students. Additionally, data from the National Student Clearinghouse Research Center reveals a further 7% decrease in enrollment since then. The rising costs of higher education and the challenges associated with student debt contribute to this disheartening trend.

Stella Flores, an associate professor at the University of Texas, Austin, criticizes the court’s decisions, stating that they present a distorted view of the nation and its history of racial exclusion. Flores argues that both issues—the denial of student debt relief and the ban on race-conscious admissions—are interconnected, arising from systemic exclusion, segregation, racial fear, and the preservation of privilege.

These rulings have left prospective students like Isaac Herrera, a rising junior at Daniel Pearl Magnet High School in Los Angeles, uncertain about their future college options.

Herrera expresses his concerns as a person of color, fearing that the widespread ban on race-conscious admissions will limit his access to the necessary resources for success. He emphasizes the importance of diversity and measures that support underrepresented groups in educational institutions.

Kairos Richardson, a resident of Athens, Georgia, shares a similar sentiment. He dropped out of college due to the financial burden of student loan debt and the challenges of balancing work and academics. Richardson aspires to study urban design and planning to uplift disenfranchised Black and Latino communities. However, without assistance in paying off his existing loan and obtaining additional grants, he believes his aspirations may remain out of reach.

The impact of these decisions extends beyond student debt, with affirmative action also being a crucial topic of concern. Reyna Patel, a student at the University of North Carolina at Chapel Hill, credits affirmative action for enhancing her chances of admission to the highly selective public university. She worries that the court’s ruling will lead to a decrease in racial diversity on campus, hindering innovative and sustainable solutions to societal issues.

Nevertheless, Patel remains hopeful, acknowledging the pivotal role of cultural and racial campus groups in fostering beneficial diversity for students of color. She believes that these groups will continue to play a vital role in creating an inclusive environment on campus.

Sara Youssef, a determined student at Westview High School in San Diego, shares her determination to navigate the college application process despite the ban on affirmative action. Drawing inspiration from civil rights activists, Youssef stresses the importance of persevering in the face of adversity. She emphasizes the need to recognize the deep-rooted flaws within the American system and work collectively to bring about positive change.

Representative Frederica Wilson (D-Fla.), ranking member on the House Higher Education and Workforce Development Subcommittee, voices her frustration at the persistent setbacks faced by people of color. She highlights the pattern of progress followed by regression, emphasizing the need for continued efforts to overcome systemic obstacles.

The recent Supreme Court rulings on student debt relief and affirmative action have sparked significant concern among students, advocates, and community members alike. These decisions are seen as potential deterrents to college access and diversity. It is imperative to address these issues to ensure that higher education remains inclusive and accessible to all.

Efforts to tackle the challenges posed by student debt are ongoing, with the Biden administration actively pursuing relief through the Higher Education Act. However, the lengthy process and ongoing accrual of interest during the reprieve period raise additional concerns. It is crucial to explore comprehensive solutions that provide meaningful relief and promote equity in higher education.

To counteract the negative impacts of the ban on race-conscious admissions, institutions must double their efforts to create diverse and inclusive campuses. This involves supporting and amplifying the voices of underrepresented students, fostering cultural organizations, and implementing proactive measures to ensure equal opportunities for all.

Ultimately, it is through collective action, ongoing advocacy, and a commitment to dismantling systemic barriers that the United States can aspire to create a fair and accessible higher education system. Students, advocates, policymakers, and communities must come together to address these issues head-on and build a future where every individual has the opportunity to pursue their educational aspirations.