The Nigerian Upstream Petroleum Regulatory Commission (NUPRC) has disclosed that Nigeria attracted investment of as much as $16 billion in the two years spanning 2023 to 2025.

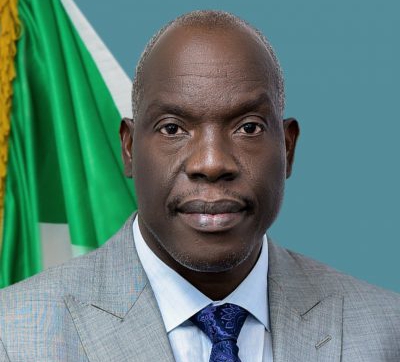

The Commission Chief Executive (CCE), Gbenga Komolafe, stated this in an address themed: “Strategic Imperatives for Advancing Investments Through Upstream Petroleum Regulations“ at the Nigeria-China Sustainable Bilateral Business, Trade, And Investment Summit in Lagos.

Komolafe stressed that under the current administration, Nigeria’s oil and gas sector has undergone transformative reforms designed to enhance operational efficiency and global competitiveness.

These reforms, he said, are underpinned by a strong commitment to regulatory clarity, investor confidence, ease of doing business, vacating entry barriers, promoting and supporting long-term industry stability, further reinforcing Nigeria as a premier destination for energy investment.

According to him, the presidential reforms were not mere policy rhetoric, but marching orders that have slashed average contracting cycles from a cumbersome 36 months to just six months, unlocking strategic tax incentives for deepwater, frontier basin, and gas projects, and dismantling long-standing fiscal bottlenecks as well as accelerating project approvals and investor confidence.

“The outcome has been extraordinary: between 2023 and 2025, Nigeria secured over $16 billion in upstream investment commitments, with renewed participation from global energy giants like Shell, TotalEnergies, and Seplat, as well as a surge of dynamic indigenous operators rising to the fore,” he added.

He stressed that the current era is defined by the call for decarbonisation yet underscored by the undeniable truth that oil and gas will remain vital to global energy security for decades to come.

Quoting from BP’s Energy Outlook 2024, Komolafe noted that hydrocarbons will still supply over half of global energy needs by 2050.

According to him, Africa’s own energy demand is poised to surge by 30 per cent by 2040, driven by rapid population growth, industrial ambition, and the rightful quest for universal energy access.

Meeting this demand sustainably, he said, will require over $600 billion in upstream investments annually through 2030, according to a study conducted by the International Energy Forum (IEF) last year.

“Distinguished investors and business leaders, Nigeria is ready! We cannot abandon our hydrocarbon potential. Instead, we must accelerate its development responsibly, sustainably, efficiently, and strategically to finance our future, power our present, and create economic prosperity for the over two hundred million Nigerians,” he pointed out.

Besides, Komolafe stated that the NUPRC is developing forward-thinking regulatory instruments and policies that promote transparency, efficiency, and innovation for the optimal development of the country’s hydrocarbon resources.

In line with its mandate to operationalise the provisions of the Petroleum Industry Act (PIA) the commission, according to Komolafe, has issued 19 regulations and has continued to oversee the administration of licenses, leases, permits, approvals, and compliance within the upstream petroleum industry.

“To enable ease of doing business and attract credible investors, licensing rounds are intentional and are conducted through a bidding process that is open, transparent, and competitive.

“To strengthen stakeholders’ confidence and streamline approval processes, issuance of regulatory instruments such as licenses and service permits is automated. For informed decision-making and investment evaluation, the National Data Repository (NDR) hosts seismic, well, and production data from across Nigeria’s sedimentary basins.

“To monitor field operations, digital tools, and operational dashboards for real time monitoring of upstream activities and compliance are deployed,” he told the audience.

According to him, Nigeria’s investment climate has been profoundly reshaped through bold and investor-focused reforms, including zero hydrocarbon tax, reduced royalty rates, tax consolidation provisions amongst others are attractive for investments.

He listed an additional suite of attractive incentives to include: Globally competitive fiscal terms, more efficient regulatory processes, and the elimination of prohibitive entry barriers to promote and attract viable investment to the oil and gas sector.

He reiterated that new investors, empowered by clarity and quality, have entered Nigeria’s sector, oil and gas reserves and production has increased, while rig counts have surged from eight in 2021 to 42 currently, with projections to reach 50 by the end of the year.

“With 210.54 trillion cubic feet of natural gas reserves, the largest in Africa, and 37.28 billion barrels of crude oil reserves, Nigeria holds enormous reserves. As the largest oil producer in Africa, Nigeria currently produces approximately 1.75 million barrels of oil per day (MMBPD) and 7 billion standard cubic feet of gas per day (BSCFD).

“However, our national aspiration is to increase production to 3 million barrels of oil and 12 billion standard cubic feet of gas per day,” he added.

He listed other opportunities in the sector to include: New frontier opportunities in onshore, shallow water and deep offshore blocks, especially in underexplored basins.

“Our new licensing rounds regime provides predictable and more frequent investment opportunities for both international companies and indigenous players to enter and expand in Nigeria’s growing energy market.

“There are also other vast and compelling transformative opportunities particularly in natural gas development as Nigeria positions gas as a strategic transitional fuel,” he said.