The National Sugar Development Council (NSDC) and the Nigerian Export-Import Bank (NEXIM Bank) are partnering to mobilise a long-term, development-oriented financing for the transformation of Nigeria’s sugar industry.

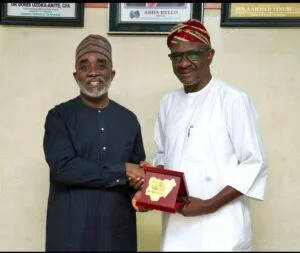

The Executive Secretary/Chief Executive Officer, of NSDC, Mr Kamar Bakrin, said thisbwhen he led a delegation to visit the Managing Director of NEXIM in Abuja.

Bakrin proposed the adoption of the Engineering, Procurement, Construction plus Financing (EPC+F) model to support viable sugar projects across the country.

Under the proposed framework, the NSDC would originate and develop bankable, policy-aligned projects and support equity mobilisation.

NEXIM Bank on the other hand would anchor capital mobilisation by facilitating access to international Export Credit Agencies (ECAs).

Bakrin said the bank would coordinate syndication with other Development Finance Institutions (DFIs), support foreign input financing and provide risk mitigation instruments, including guarantees and commercial risk insurance.

He highlighted the enormous market potential within Nigeria and across Africa, adding that Nigeria’s sugar market was valued at approximately two billion dollars, while the African market stood at about seven billion dollars.

He added that sugar by-products accounted for a market exceeding 10 billion dollars in Nigeria.

“Nigeria cannot achieve self-sufficiency in sugar production on short-term capital. What the sector requires is patient, long-tenor financing deployed at scale and backed by policy certainty.

“By partnering with NEXIM Bank and international export credit partners, we are putting in place a financing architecture that allows serious investors to execute, not speculate,” Bakrin said.

He said Nigeria was strategically positioned to serve both domestic and regional markets under the African Continental Free Trade Area (AfCFTA), provided adequate long-term financing was deployed to expand sugarcane cultivation and processing.

Bakrin explained that the EPC+F financing model had already been deployed through NSDC’s partnership with SINOMACH, a Chinese engineering and industrial conglomerate.

He said the arrangement had secured financing of up to $1billion at the Secured Overnight Financing Rate (SOFR) plus three per cent, with a 15-year tenor and three-year moratorium, to accelerate the development of large-scale sugar projects.

According to him, the model is projected to deliver annual foreign exchange savings of about 300 million dollars through import substitution.

The executive secretary said it would also create more than 50,000 jobs across the sugar value chain and achieve up to 25 per cent import substitution within five to 10 years.

Bakrin said the council had initiated institutional reforms to de-risk investments in the sugar sector.

He said this included efforts to codify the Nigeria Sugar Master Plan (NSMP) into law through amendments to the NSDC Act to ensure policy continuity and investor protection.

He added that enforcement measures were being strengthened to curb smuggling and discourage the influx of cheaper sugar products into the country.

The NSDC boss said large-scale sugar projects were designed to generate employment opportunities across farming, processing, logistics and ancillary services, while integrating smallholder farmers through outgrower schemes.

He said host communities would also benefit through employment opportunities, skills development and investments in infrastructure, healthcare and education.

Bakrin said that sugarcane cultivation aligned with environmental sustainability goals, as it functioned as a renewable crop and year-round carbon sink, while also supporting renewable co-products such as ethanol and bioelectricity.

Responding, the Managing Director of NEXIM Bank, Mr Abba Bello, welcomed the initiative and acknowledged the strategic importance of the sugar industry to Nigeria’s economic diversification and export development objectives.

Bello expressed the bank’s readiness to explore structured partnerships that would unlock long-term financing, strengthen local value chains and enhance Nigeria’s competitiveness in regional and global markets.

He commended the execution-focused approach adopted by the NSDC and reaffirmed NEXIM bank’s commitment to supporting viable export-oriented and import substitution projects aligned with national development priorities.