The Executive Chairman of the Federal Inland Revenue Service (FIRS), Dr. Zacch Adedeji, has urged media practitioners to take a more active role in promoting voluntary tax compliance across Nigeria.

Adedeji, represented by his Technical Assistant on Broadcast Media, Arabinrin Aderonke, made the appeal on Wednesday in Kaduna at a one-day sensitisation programme themed “The Role of Media in Voluntary Tax Compliance,” organised by his office.

He described the media as a “watchdog, educator, and bridge” between government and citizens, stressing its critical role in building public trust in the tax system.

“Many people still see taxes as a burden rather than a civic duty. What we need is a culture of voluntary compliance where citizens willingly pay because they understand the benefits and trust the system,” Adedeji said.

He noted that taxation remains the backbone of national development, funding essential services such as education, healthcare, infrastructure, and social welfare. He added that investigative journalism helps hold officials accountable, thereby boosting confidence in government institutions and encouraging compliance.

In a technical paper, Mr. Mohammed Adamu defined voluntary tax compliance as the willingness of taxpayers to declare income accurately, keep proper records, file returns, and pay taxes without enforcement pressure. He explained that it reduces the cost of enforcement, curbs tax evasion, and fosters national development.

Mr. Ishaku Ankama, Senior Manager, Government Business Office, Kaduna FIRS, provided practical tips, including accurate registration and timely payment of taxes. He emphasised that adherence to tax regulations strengthens social stability and contributes to economic growth.

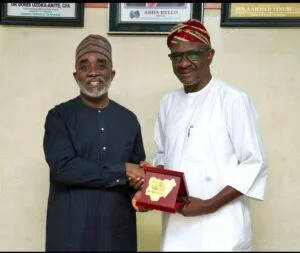

The Chairman of the Nigeria Union of Journalists (NUJ), Kaduna State Council, Alhaji Abdulgafar Alabelewe, commended FIRS for the training and pledged journalists’ support in enlightening the public on the benefits of tax compliance.

The programme ended with participants pledging to use their platforms to amplify tax-related conversations as part of their national duty.