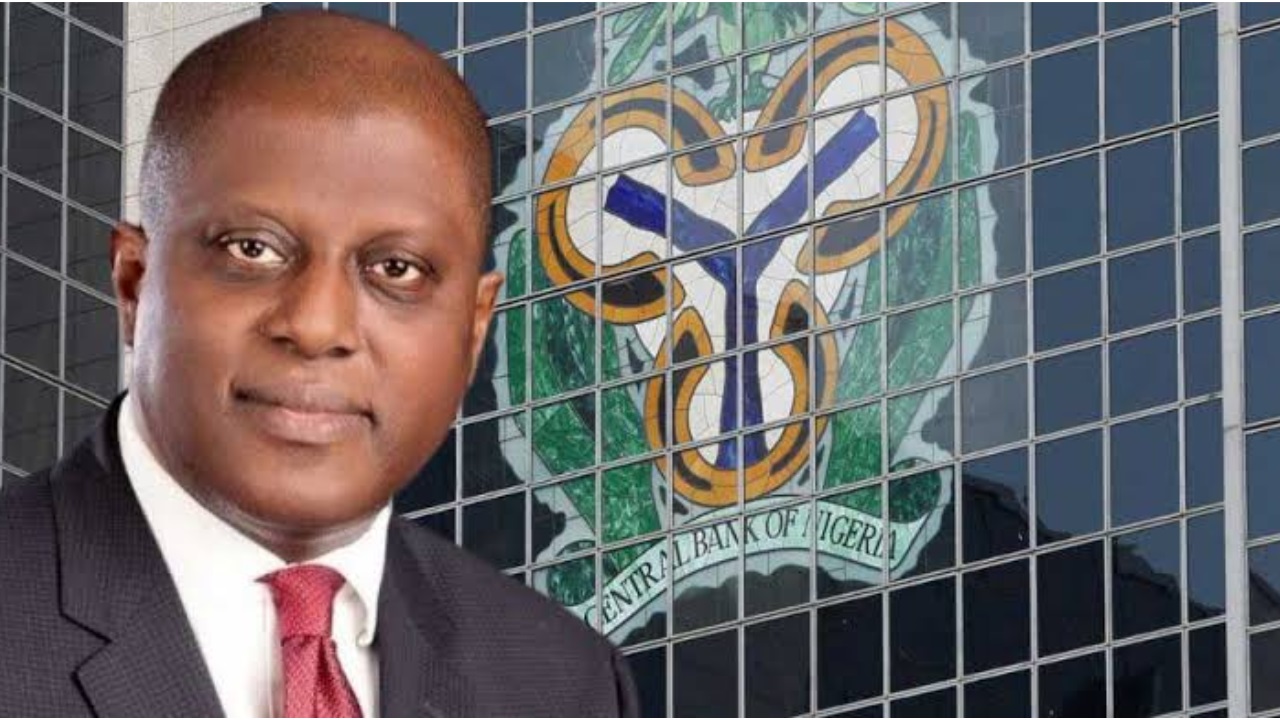

The Centre for the Promotion of Private Enterprise (CPPE) says the decision of the Monetary Policy Committee (MPC) of the Central Bank of Nigeria (CBN) to hold the interest rates was anticipated.

Dr Muda Yusuf, Chief Executive Officer of CPPE, said this in an interview with the News Agency of Nigeria (NAN) on Wednesday in Lagos.

Yusuf said that although the decisions of the MPC were not surprising, the apex bank and managers of the nation’s economy must evolve additional strategies, including trade policy shifts against inflation.

He was responding to the outcome of the 301st MMPC meeting.

NAN reports that the MPC retained the rates for the third consecutive time, holding the Monetary Policy Rate (MPR) at 27.5 per cent.

The Cash Reserve Ratio (CRR)was retained at 50 per cent for deposit money banks and 16 per cent for merchant banks.

It also retained Liquidity Ratio at 30 per cent and the Asymmetric Corridor at +500/-100 basis points around the MPR.

Yusuf said that the outcome was anticipated based on current realities, adding that the decision had both positive and negative consequences for the nation’s economy.

He said it was expected that current rates would be maintained due to CBN’s consistent approach of not cutting rates until inflation significantly moderates.

He said that inspite of marginal deceleration in annual inflation to 22.22 per cent, month-on-month headline, food, and core inflation all increased in June.

According to him, the CBN cited inflationary trends coupled with persistent factors like high energy costs, insecurity, exchange rate volatility and logistics expenses as reasons for its decision.

He stressed the need for more affordable funds to boost economic growth and investment, noting that interest rates exceeding 30 per cent are highly prohibitive.

The CPPE boss, however, said that economic management involved trade-offs.

He said that CBN’s tight monetary stance, characterised by high interest rates, had successfully attracted an inflow of foreign exchange through portfolio investments.

Yusuf said that the influx of forex was a key positive outcome that justified CBN’s decision to maintain monetary tightness, even if it appears to hinder direct investment and growth.

He said that CBN’s decision had several implications adding that financial instruments will continue to offer attractive returns, benefiting investors in these areas.

“High interest rates are also favorable for attracting portfolio inflows,” he said.

“The downsides included continued pressure on the real sector and borrowers, as the cost of servicing debts will remain high, potentially for at least the next two months until a policy review.

“The CBN and the managers of the economy generally should look beyond monetary policy instruments because, alone, it cannot tackle inflation,” he said.

Yusuf said that the country needed factors that could bring down th cost of production, distribution, and the cost of importation of critical input for production.

“There are already some action, we need more effective and impactful actions on insecurity, so that our food production can also be scaled up.

“These are some of the additional things that need to take place on the policy front to complement whatever the monetary policy authorities are doing.

“Clearly, monetary policy alone or monetary policy instruments alone are not sufficient to effectively tackle inflation,” he said. (NAN)